The Reform Of IPO System Seems To Go Astray.

The reform of IPO system seems to go astray.

"Not only minor repairs, but also a retrogression of marketization." For the Ching Ming Festival,

The reform measures proposed by the SFC include: introducing individual investors to inquire, raising the proportion of placing under the net, strengthening supervision over the issue pricing, canceling the locking period of placing shares under the net, and punishing those whose performance is not up to expectations.

This is a heavy message in the capital market. Generally speaking, reform measures are a good sign at the same time. However, when institutional investors applauded, the academic community almost collectively declined.

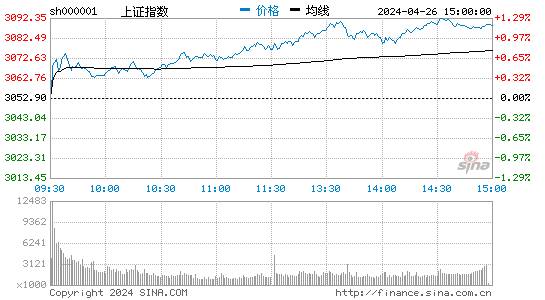

On the first trading day after the holiday (5), the Shanghai Composite Index rose 1.74%, while the Shenzhen Composite Index rose 3.17%. I'm afraid the stock market is not so exciting. ipo The advent of the reform program is good news for management to substantially raise QFII (qualified foreign institutional investors) and RQFII (RMB qualified foreign institutional investors) quota of 50 billion US dollars and 50 billion yuan RMB.

Turn right and turn left.

According to the guidance, the issue price is higher than that of the listed companies in the same industry.

Although this new regulation appears to be severe, it has also been recognized by some people in the industry. However, in Wahson's view, this is no more than a retrogression in the market.

"Does this mean that there is no liability as long as less than 24%? This is no more than 30 times the price of the new shares changed in 2009, and the window guidance of the P / E ratio is no different. If this is done, the new inquiry link can be cancelled. " Wahson said.

CCTV news editor and commentator of the securities information channel, Su Pei Ke, likened the reform of the distribution system to "turn right lights to the left".

The introduction of individual investors to participate in the inquiry is also one of the guiding points of this guidance. The guidance points out that the leading underwriters can independently recommend 5~10 individuals with relatively rich investment experience to participate in the inquiry placing on the Internet.

Lin Yi, chairman of the Beijing sky care company, asked this question on micro-blog: "did you forget that more than 10 years ago, the securities dealers allocated new shares to the stakeholders, and the shareholders could not get anything?"

Wahson also believes that this approach is of little significance, and underwriters will only choose those who stand on their own.

Institutional investors applaud

As far as the management circles are concerned, it will be a great deal of cold water for the management circles. But for institutional investors, raising the proportion of the placing under the net and canceling the current three months' lock up period under the net placing shares are really effective.

According to the guidance, the proportion of placing shares to investors under the net is no less than 50% of the public offering and transfer shares. When the net winning rate is 2~4 times higher than the winning rate on the Internet, the issuer and underwriter should return 10% of the offer shares from the net to the Internet. When more than 4 times, the 20% of the offer shares should be sent back from the net to the Internet.

A fund manager who often participates in playing the new fund tells the investor newspaper that the cancellation of three months' lock will not change the original new path, and "it is equal to a more escape route. The abnormal fall of new shares will not die."

In addition, raising the proportion of placing under the net means a new success rate for institutional investors.

The fund manager of an old ten fund company also admitted that the change of the two rules is good for institutional investors, but he said it should be neutral.

"The terms have increased the proportion of offline organizations, so that the circulation of plates has increased, because the proportion of retail investors has been relatively large. New shares It is difficult to form consensus expectations because of its very fragmented holdings, so the pressure is limited, but now the proportion of the institutions has increased. Once there is a stir, the pressure will be larger. This will undoubtedly increase. New shares Fluctuations. Therefore, in this sense, institutions should be more cautious in playing new roles.

In view of the cancellation of the lock up period, he said: "because the cancellation period has been cancelled, some fund managers will fight for the new first, win the first prize first, and then find that they can't throw it away immediately."

In addition, the guidance points out that it is proposed to increase the penalties for financial false disclosure, and the issuers are subject to financial fraud and profit manipulation and other major violations of law and regulations. They must be investigated and prosecuted, and the company's legal representatives, financial leaders and related personnel should be investigated and punished.

In response, another fund manager interviewed by reporters said: "increasing the intensity of illegal punishment can effectively reduce the potential risks of new shares".

Stir up or come back again.

In addition, the policy of deregulation of institutional investors, such as the cancellation of the lock period, is concerned that if we follow the current guidance, we will reopen the new wave of speculation.

"Raising the proportion of investors placing shares under the net, canceling the lockup period of three months of placing shares under the net, and so on, have given most of the benefits of the primary market to institutional investors, while the cancellation period has been cancelled. New shares

Cao Fengqi also believes that this regulation will be directed to the interests of institutional investors, and will further damage the legitimate rights and interests of small investors.

Economist Wahson has similar concerns. According to Wahson analysis, the current guidance restricts the high price earnings ratio and high share price, improves the proportion of offline distribution, and cancels the lockup period of three months, which has facilitated the organization's new speculation.

Li Jiange, chairman of CICC, also said at the Boao Forum: ipo There are hidden dangers in the draft, generally speaking, to prevent overpricing, but this may be to investors. New shares The impression that the price is too low is likely to make a comeback.

- Related reading

Stock Market News: Stock Index Fell 0.9%&Nbsp; CPI Data Suppressed Bull Sentiment.

|- Regional investment promotion | Shishi Clothing And Creative Expo Garden Is About To Create Designer "Silicon Valley".

- Shoe material | Xie Long Leads The Innovative Concept Of Cloth Shoe Material

- Association dynamics | Dezhou Cotton Association: Local Cotton Planting Area Glides Sharply

- Fashion shoes | 2014 Spring And Summer Worth Of Leather Sandals.

- Shoe material | Shoddy Leather Shoes Accessories Black Workshops Hiding Villages In The City Are The Key Targets.

- Recommended topics | 耐克鞋厂罢工是工人维权意识加强

- Recommended topics | Online Shopping A Pair Of Shoes Actually Lost More Than Ten Thousand Yuan Really Strange.

- Expo News | The Outdoor Wind Became The Mainstream At The Shoe Expo.

- Recommended topics | 穿平底鞋是不是最安全呢?

- Global Perspective | Shoe Fair International Procurement, Close To The Purchase Amount Of Nearly $40 Million.

- Soochow Securities: The Market Will Face Greater Pressure.

- Stock Market News: Stock Index Fell 0.9%&Nbsp; CPI Data Suppressed Bull Sentiment.

- Comparison Between Sports Brand Lining And Nike

- Listed Companies Are Now Laying Off Workers: Home Appliances, Textiles And Other Industries Become The Worst Hit Areas.

- Guo Weiqing: Middle Income Is A Pie &Nbsp, Or A Trap?

- Zhu Hai: Why Is China'S Happiness Index Lower Than Russia And India?

- Sandals Appeared In The First Half Of The Month In &Nbsp; The Average Price Was 20% Higher Than Last Year.

- Europe'S Currency Fell &Nbsp, And The US Dollar Gained Strength.

- Global Financial Markets A Big Theme On Friday

- 运动品牌代言初探草根营销战略