A Shares In Two Days "Evaporation" Of 4 Trillion Market Value Of Foreign Capital Fleeing Private Placement Passive Reduction

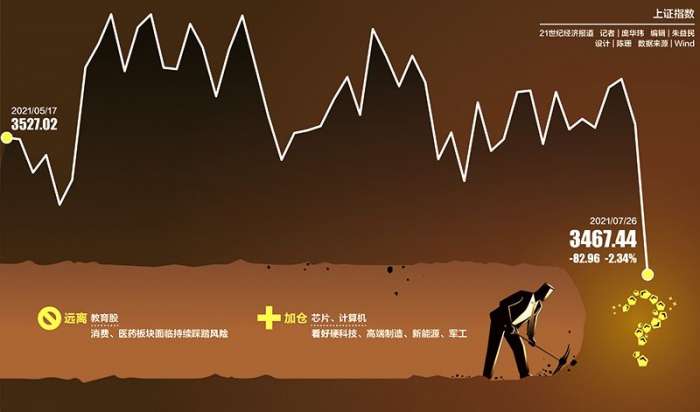

On July 27, the three indexes of a shares accelerated their diving.

By the end of the day, the Shanghai Composite Index closed at 3381.18, down 2.49%, missing the 3400 mark; The Shenzhen composite index fell 3.67% to 14093.64; The gem index fell 4.11% to 3232.84. More than 3000 stocks in the two cities are floating green.

Prior to this, the hottest topics in the market have weakened sharply, with the decline of battery plate, silicone and chemical fertilizer industry leading the way, "Mao index", liquor, non-ferrous metals, etc. all decreased significantly. In the early stage, the ETF of King's new energy vehicle fell by nearly 6%, the non-ferrous metal ETF and environmental protection ETF fell by nearly 5%, and the consumption 50ETF fell by 4.6%.

In terms of individual stocks, Ningde times, which was once called the "eternal God", dropped by 8.3% to 495 yuan / share, while Guizhou Maotai, the leading high-end liquor maker, reported 1712.89 yuan / share, down 5.06%.

Some private investors believe that the recent market slump is mainly due to the influence of external factors. "The recent trend of RMB devaluation has strengthened the pace of foreign capital withdrawal, so Hong Kong shares have fallen and a shares have also fallen." Some people from securities companies also said that because private placement has warning lines and closing lines, some of them may have been passively reduced, and public offering may also be passively reduced due to redemption.

Then, who is the main force of the air force, including foreign investment, public offering and private placement?

In the last three trading days, the accumulated net sales of northbound funds exceeded 21 billion yuan. Visual China

Foreign capital flight

In the last three trading days, the accumulated net sales of northbound funds exceeded 21 billion yuan.

Huaxi Securities believes that the implementation of regulatory policies in some fields may lead to uncertainty in the main business operation of Companies in some industries, causing market concerns. The domestic economic growth mode has changed to high-quality growth, and the market investment environment is also undergoing profound changes. It is expected that there will still be some pressure on the policy level in the future.

According to the data of a third party study, in May, foreign capital has significantly reduced the positions of Sany Heavy Industry, Boea, Weichai Power and gol shares, with a decrease of more than 10%.

The 21st century economic reporter learned that foreign institutions are speeding up their flight from China's capital stocks.

Cathie wood, a well-known investor, is one of the most beautiful investment companies in the U.S. market in 2020. The net value of its products soared by 170% that year, known as "the female version of Warren".

But now wood is speeding up its flight from Chinese stocks. According to media reports, only 0.32% of the $23 billion assets under the management of ark innovation ETF, her largest fund, are invested in Chinese enterprises, up from 8% in February this year. About 3.8% of the ark next generation Internet ETF is still invested in China, but it is also down from nearly 9% earlier this year.

Passive reduction of private placement

Some people from a securities firm in Shenzhen believe that private funds may passively reduce their positions on Tuesday.

As of July 23, among the 10 billion private equity subjective long strategy products, Shenzhen tairun Haiji Asset Management Co., Ltd. has lost more than 20% of its products since its establishment, according to private placement network data.

Private placement personage introduced that in order to protect the principal of investors when the fund operation is not smooth and there are losses, private funds generally set up warning lines and stop loss lines.

In other words, the warning line of a fund is 0.80. If the net value of the fund is lower than 0.80 after the market closes on a certain day, the net value of the fund will fall below the warning line, and the fund manager will reduce the fund's position to prevent the fund from falling below the stop loss line.

If the net value of the fund is lower than the stop loss line of 0.70 after the close of the market on a certain day, the fund manager can only do the selling transaction from the next day, and can not buy any more, and the fund will enter into liquidation procedure.

The 21st century economic report also learned that, as of July 23, in addition to tairun Haiji, some new products of private placement, such as Wanfang capital, dongfanggang Bay and Danshui spring managed by Dan bin, have lost more than 13% since their establishment, which is close to the warning line.

On the evening of July 26, Dan bin publicly apologized: "after 29 years of practice, Dongfang harbor has been established for more than 17 years, and 2021 will be regarded as another test! This year, in addition to the positive contribution of US stocks, both A-shares and Hong Kong stocks have made negative contributions... "Dan bin also said that he only blames himself for his bad performance and is also in the process of introspection.

Previously, Dongfang harbor once touched the warning line due to the withdrawal of 20% of the new products established this year. In May, it sent an explanatory document to the investors of the product to express its apology. "After the year, the stock market suffered a great adjustment, and the net value of the products was greatly affected. The leading stocks of" Baotuan ", which had a large increase in the early stage, generally fell, and the cyclical stocks with cold performance rose sharply, and the overall market fluctuated violently. In particular, more than 20% of the liquor, Internet retail and other industry leaders had withdrawn; The largest withdrawal of automobile manufacturing leaders is nearly 50%. " At that time, Dan Bin said that he would adhere to the concept and focus on adding warehouse and investing in this product.

The above securities dealers believe that the market diving on Tuesday will affect more private placement products to reduce their positions passively.

According to the latest data of China Galaxy Securities Fund Research Center, according to the difference between the current position proportion of each stock in the fund direction disclosed in the second quarter of 2021 and the upper limit of stock proportion specified in the fund contract, it can be calculated that the remaining funds available to buy A-share stocks of these funds at the end of the second quarter of 2021 is 730.204 billion yuan.

Industry insiders also said that public offering in the second quarter has been reducing positions, and the stock direction of funds have fund positions, should not be considered the main drop at present.

Ten billion private placement should be greedy

Great Wall Fund believes that in the long run, the risk is not big.

Great Wall Fund said that at the macro level, the recent superposition of multiple factors led to greater market sentiment volatility. The introduction of strong regulatory policies in the education industry has led to a heavy setback in China capital stocks, and overseas funds are more worried about policy risks; The domestic epidemic situation repeatedly leads to the fluctuation of investor sentiment; At the Sino US Tianjin talks on July 26, uncertainty in international relations also led to market sentiment instability.

From the track point of view, the early new energy vehicle industry chain has continued to perform strongly, and has accumulated a wave of growth, and the valuation has risen to a high level. Therefore, when the market weakens, it returns to the reasonable position mean value. At the same time, as the track of public funds' heavy positions, fund position adjustment also has an impact on the stock price.

Building materials plate fell sharply, mainly driven by flat glass price adjustment expectations. Prior to this, the price of flat glass reached a relatively high level, which squeezed the downstream space to a certain extent. Therefore, the market has potential policy risks for flat glass and formed a price reduction expectation.

Looking forward to the future, the supply and demand structure of flat glass is stable and healthy, and is about to usher in the peak season of demand. In the long run, the price risk is not big.

"Today, Hong Kong stocks fell sharply, and the Hang Seng technology index fell by more than 8%. It can be said that at the beginning of the year, we are struggling to do arbitrage between a shares and H shares Yang Ling, general manager of 10 billion private equity star stone investment, said that there were three reasons for the decline of a and H shares

First of all, the uncertainty of international relations caused market concerns, Hang Seng technology index adjusted sharply for two consecutive days, and A-share sentiment was also affected;

Secondly, the implementation of regulatory policies in some fields may lead to uncertainty in the main business operation of Companies in some industries. For example, the "double reduction" policy has been officially implemented recently, the real estate regulatory policy has become more stringent, and the anti-monopoly and disorderly expansion of capital are prevented;

Finally, the stage adjustment caused by excessive concentration of early growth track trading and profit taking of floating profit plate.

On the whole, it is still the high valuation plate with a larger decline. In the short term, due to the relatively slow economic recovery and the policy to be digested by the market, the market risk preference is still facing suppression. However, the adjustment has also pushed out the bubble and driven the rebalancing of the market structure to a certain extent. The post cycle categories with high margin of safety and tending to repair fundamentals are expected to be revalued.

Although the market mood is more scared, but Yang Ling said she still wants to be greedy.

- Related reading

After A-Share Crash, Institutional Bottom Copy Roadmap Emerges: Away From Education Stocks, Favor "Ning Index"

|

China Securities Regulatory Commission And National Development And Reform Commission Re Discuss Trillion Reits Market

|

China Securities Regulatory Commission (CSRC) Has Released Strong Regulatory Signals For Two Consecutive Weeks, And Has Completed The Deployment Of "Zero Tolerance" Strike

|- quotations analysis | Analysis Of Factors Affecting PX Market In The Near Future

- Market topics | The Trade Volume Of Silk Goods Of 27 EU Countries In April Was US $951 Million, Down 5.83% Month On Month

- Fabric accessories | Focus On China Fabric Star

- regional economies | Australia Is Expected To Produce 2.8 Million Bales Of Cotton This Year

- regional economies | India'S Import And Export Of Silk Commodities From January To April 2021

- regional economies | India'S Import And Export Of Silk Commodities From January To April 2021

- News Republic | Preparing For The Final: 2021Getwow Top 30 Finalists Are Ready To Go!

- financial news | After A-Share Crash, Institutional Bottom Copy Roadmap Emerges: Away From Education Stocks, Favor "Ning Index"

- Listed company | More Than 10% Drop In Property Stocks: Where Is The Future Of The Collective Slump?

- Market topics | Global Textile: Onitsha Market In Nigeria

- Under The "Lack Of Core": Dawan District Enters The Global Semiconductor Manufacturing Highland Competition

- Behind The Growth Of Guangdong Chip: The Semiconductor Industry In Dawan District Explores The Road Of "Third Pole"

- "Price Limit" Turns To Second-Hand Housing Multi City One Second Hand Linkage Stable Expectation

- Less Than A Week From "Engagement" To "Break Up": Why Did The Merger Of Weining Health And Venture Huikang End?

- WTO Exempts The New Crown Vaccine Patent Negotiation To Be Deadlocked, How To Solve The Global Vaccine Accessibility Problem?

- The New Policy Protects The "Casual Economy" And The Rights And Interests Of Takeout Workers Are More Protected

- Analysis Of Factors Affecting PX Market In The Near Future

- The Trade Volume Of Silk Goods Of 27 EU Countries In April Was US $951 Million, Down 5.83% Month On Month

- Focus On China Fabric Star

- Australia Is Expected To Produce 2.8 Million Bales Of Cotton This Year