The Textile Industry Will Benefit Significantly If The Schedule Of Tax Rebate Policy Is Determined

This year's "two sessions" government work report pointed out that the implementation of new combined tax support policy. We should adhere to the combination of phased measures and institutional arrangements, and develop tax reductions and tax rebates at the same time. "It is estimated that the tax rebate and tax reduction for the whole year will be about 2.5 trillion yuan, including 1.5 trillion yuan of tax rebate, and all the tax refund funds will go directly to enterprises." Who will be returned to such a scale? When is the refund? How to return it?

On March 21, Premier Li Keqiang of the State Council presided over the executive meeting of the State Council to determine the policy arrangements for the implementation of large-scale value-added tax rebate, so as to provide strong support for stabilizing the macro-economy; We will deploy comprehensive measures to stabilize market expectations and maintain a stable and healthy development of the capital market.

Determination of the schedule of tax rebate policy

Another 1.2 trillion yuan of transfer payment funds will be arranged

- Related reading

The Internet Of Textile Industry Provides A New Direction For The Development Of Textile Industry

|

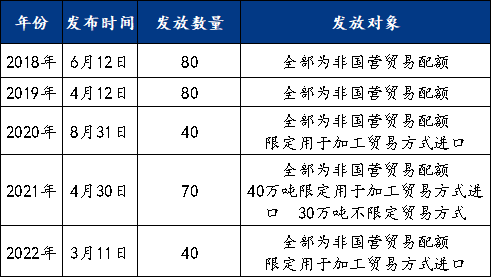

National Development And Reform Commission: Alleviating Cotton Consumption Dilemma

|

The United States: In The Guise Of "Peaceful R & D", It Actually Engaged In Bio Military Activities

|- Daily headlines | The Textile Industry Will Benefit Significantly If The Schedule Of Tax Rebate Policy Is Determined

- Wealth story | Tencent'S Revenue In 2021 Is 560.1 Billion Yuan, And The Income From Disposal Of Jingdong Shares Is 78.2 Billion Yuan

- Local businessmen | RCEP: Textile Export Growth Of Fujian Province

- Market trend | Market Dynamics: Ice Cotton Up With Execution Risk Increases

- Industry stock market | Xinhua Jin (600735): Progress In Providing Guarantees For Subsidiaries

- Foreign trade information | The United States Resumed Tariff Exemption On 352 Chinese Imports

- Industrial Cluster | Industrial Cluster: Pakistan'S Textile And Clothing Exports Increased By 26.08%

- Local hotspot | Marching Towards "100 Billion Cluster" -- Behind The "Gorgeous Turn" Of Yudu County Textile And Garment Industry

- market research | Market Research: The Rise Of Chinese Brands Is Facing A New Round Of Transformation

- regional economies | Vietnam Government Issues Economic And Social Recovery And Development Plan, Enterprises Return To Work Quickly

- Tencent'S Revenue In 2021 Is 560.1 Billion Yuan, And The Income From Disposal Of Jingdong Shares Is 78.2 Billion Yuan

- RCEP: Textile Export Growth Of Fujian Province

- Market Dynamics: Ice Cotton Up With Execution Risk Increases

- Xinhua Jin (600735): Progress In Providing Guarantees For Subsidiaries

- The United States Resumed Tariff Exemption On 352 Chinese Imports

- Industrial Cluster: Pakistan'S Textile And Clothing Exports Increased By 26.08%

- Marching Towards "100 Billion Cluster" -- Behind The "Gorgeous Turn" Of Yudu County Textile And Garment Industry

- Market Research: The Rise Of Chinese Brands Is Facing A New Round Of Transformation

- Vietnam Government Issues Economic And Social Recovery And Development Plan, Enterprises Return To Work Quickly

- New Materials: Antibacterial Textiles Developed In Russia